However, since the production process takes three weeks to complete, all the units produced in the last half of March will be in WIP inventory at the end of March. Notice that under this Equivalent Units method of allocating costs, no direct materials were allocated to ending work in process because the EUs were zero. However, because we are using the average method instead of the First-in, First-out (FIFO) method, which uses the assumption that the flow of goods through the system is a constant mix, we still have costs left in the “transferred in” column.

Production Report – Subsequent Department – Weighted Average

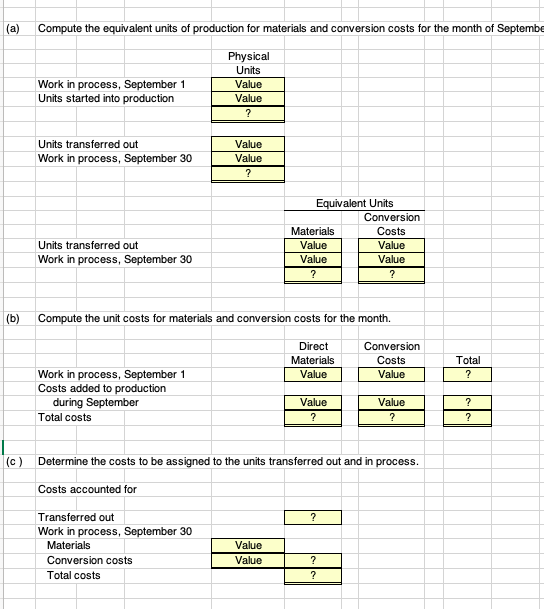

Using a FIFO cost-flow assumption, we would have allocated those costs to finished goods first. Establish the total inventory in production by adding units started into production to beginning work in process (what was left only partially finished at the end of the prior month). For this example, we will assume that all pie shells in process were completed in December, and the facility was shut down over the holiday break for annual repairs, maintenance, and deep cleaning. So, the beginning inventory of zero plus the 2,250 pie shells transferred in from the mixing department during the month gives us a total number of units to account for of 2,250. Prepare the journal entry to record the cost of units completed and transferred out.

Process Costing – all with Video Answers

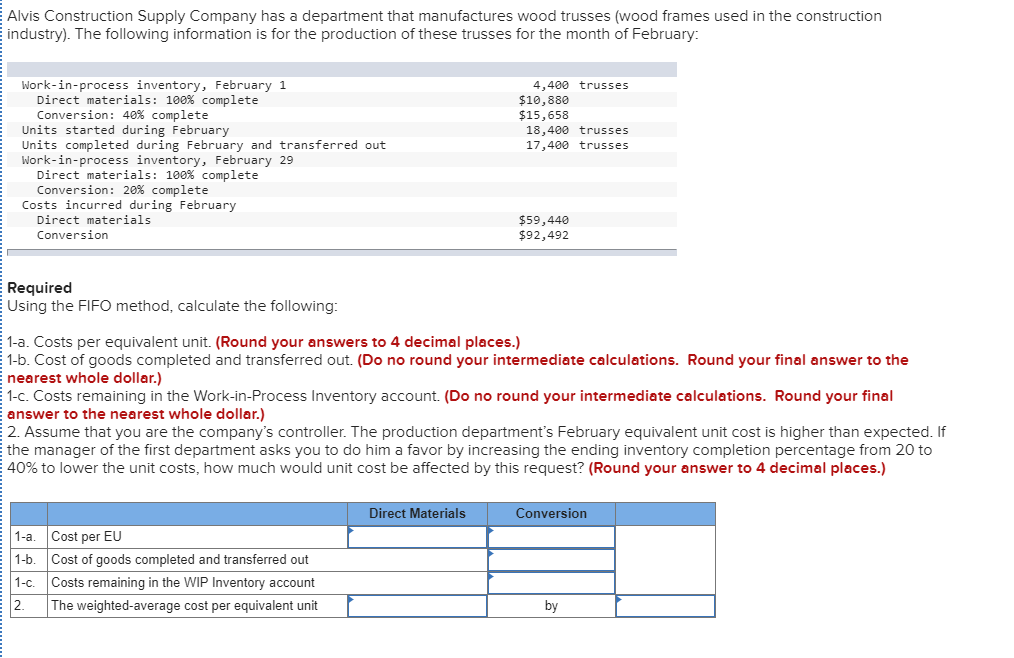

From the accounting records, we see that total direct materials used in January by the baking/packaging department were $600, and direct labor and manufacturing overhead totaled $4,100. We divided those amounts by the related Equivalent Units to come up with a cost per EU. For purposes of this example, we’re going to combine the baking and packaging departments into one cost center. Calculate the equivalent units of production with respect to materials during the month of March using the weighted average method. Armed with the preliminary production cost report for March, and knowing that the company’s production is well below capacity, the CEO and CFO decide to produce as many units as possible for the last half of March even though sales are not expected to increase any time soon. The production manager is told to push his employees to get as far as possible with production, thereby increasing the percentage of completion for ending WIP inventory.

Strategic Direction

- Armed with the preliminary production cost report for March, and knowing that the company’s production is well below capacity, the CEO and CFO decide to produce as many units as possible for the last half of March even though sales are not expected to increase any time soon.

- Total costs of $9,650 are the $4,950 transferred in from the mixing department plus the $4,700 incurred in baking and packaging.

- Calculate the equivalent units of production with respect to materials during the month of March using the weighted average method.

- Before we examine the FIFO method, let’s complete the production cost report for this department and check your understanding of how subsequent departments differ from the first department.

- Thus, all the costs from both departments are accounted for and allocated to the proper category.

Notice that the “Transferred In” column comes right from the mixing department Production Cost Report.

Cost Flows Through Journal Entries

Remember, Equivalent Units will be used to come up with an overall allocation rate that will then be used to allocate total costs between products completed and transferred out and products still in the process. Cost Flows LO4-1Lubricants, Inc., produces a special kind of grease that is widely used by race car drivers. Before we examine the FIFO method, let’s complete the production cost report for this department and check your understanding of how subsequent departments differ from the first department. Total costs of $9,650 are the $4,950 transferred in from the mixing department plus the $4,700 incurred in baking and packaging.

Step 1 – Calculate units to account for

Material is added at the beginning of the process, and conversion costs are incurred evenly throughout the process. Preparing the Production Cost Report for subsequent departments is similar to preparing the report for the first department, with the addition how big companies won new tax breaks from the trump administration of a column for costs transferred in. Thus, all the costs from both departments are accounted for and allocated to the proper category. Mary manages the plant located in Des Moines, Iowa, while Gary manages the plant in El Segundo, California.

Production managers are paid a salary and get an additional bonus equal to $5 \%$ of their base salary if the entire division meets or exceeds its target profits for the year. The bonus is determined in March after the company’s annual report has been prepared and issued to stockholders. Now, check your understanding of the second or subsequent stage of a multi-step process using the weighted-average method of process costing. After posting the entries to the T-accounts, find the ending balance in the inventory accounts and the Manufacturing Overhead account. “Yes, it does seem high; but on the other hand, I know we had an increase in materials prices during April, and that may be the explanation,” replied Mr. Harrop. “I’ll get someone else to redo this report and then we can see what’s going on.”