There’s often an option to view all the transactions within a particular account, too. A standard COA will be a numbered list of the accounts that fill out a company’s general ledger, acting as a filing system that categorizes a company’s accounts. It also helps with recording transactions and organizing them by the accounts they affect to help keep the finances organized. If you’ve worked on a general ledger before, you’ll notice the accounts for the ledger are the same as the ones found in a chart of accounts.Keeping your books organized does not need to be a chore. Many small businesses opt to utilize online bookkeeping services, not only for invoicing and expense tracking but also for organizing accounts and ensuring tax season goes smoothly. FreshBooks accounting software is an affordable and reliable option for online bookkeeping services that will help you stay on track and grow your business.

Best Accounting Software for Small Businesses of 2024

A well-structured chart of accounts (COA) facilitates precise financial reporting and enables organizations to make informed decisions. Ensuring COA accuracy entails having a system that is scalable, provides granular visibility divestiture definition and streamlines data recording. HighRadius’ Record to Report (R2R) solutions provide organizations with end-to-end capabilities to streamline and automate various accounting processes and achieve 95% journal posting automation.

Liabilities

The use of such advanced technology in managing the COA leads to greater efficiency in financial reporting and more informed strategic decision-making across the organization. Ensure your COA aligns with applicable accounting standards and legal requirements. For instance, a manufacturing business might need detailed accounts for different types of raw materials. This includes adding accounts specific to your industry or operational needs. Under each main category, there can be several sub-accounts to provide more detailed tracking. See a free Excel template with a standard chart of accounts with payroll expenses, etc.

Great! The Financial Professional Will Get Back To You Soon.

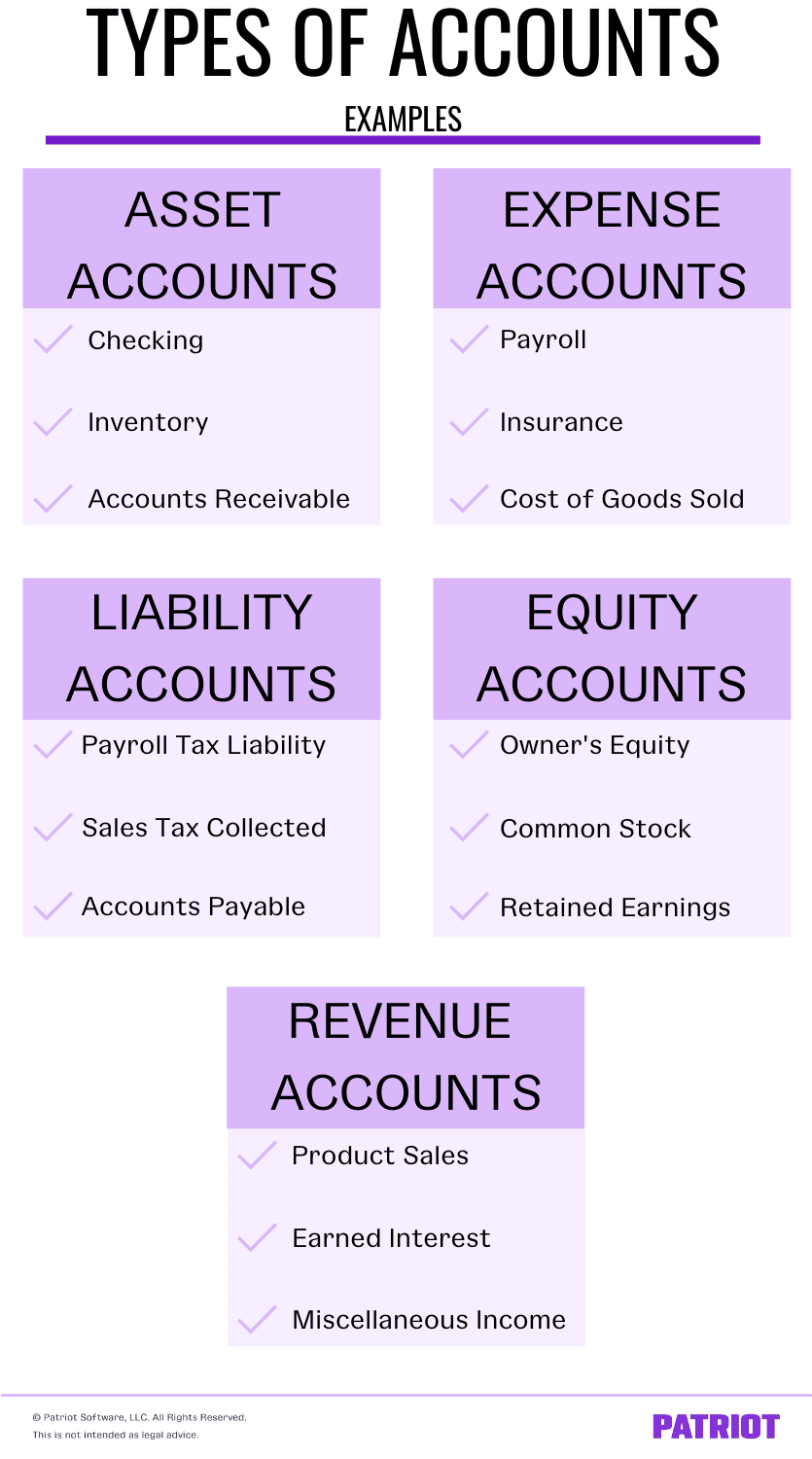

By offering real-time visibility into variances and discrepancies, this tool helps finance teams quickly identify and address issues, ensuring that the COA reflects accurate and current financial data. By selecting the appropriate type of COA, businesses can achieve more accurate and efficient financial management. To better understand the balance sheet and income statement, you need to first understand the components that make up a chart of accounts. Knowing how to keep your company’s chart organized can make it easier for you to access financial information. The COA is usually hierarchical, with accounts organized in categories and subcategories. These categories include assets, liabilities, equity, revenue, and expenses.

Is there any other context you can provide?

- He sells his old truck and gets a $1,500 and purchases a new truck for $25,000.

- Below, we’ll go over what the accounting chart of accounts is, what it looks like, and why it’s so important for your business.

- The charts of accounts can be picked from a standard chart of accounts, like the BAS in Sweden.

- This list includes every category under which you can classify money spent or earned by your business, from the salaries paid to employees to the revenue from sales.

- A well-structured COA provides a comprehensive view of financial activities, enabling detailed analysis for informed decision-making.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. To make it easy for readers to locate specific accounts or to know what they’re looking at instantly, each COA typically contains identification codes, names, and brief descriptions for accounts. But the final structure and look will depend on the type of business and its size. Obligations can be filled through the transfer of funds or the provisioning of goods or services to cover the debt. Both short-term (typically less than a year) and longer-term liability accounts exist. Companies should also ensure that the COA format remains the same over a period of time.

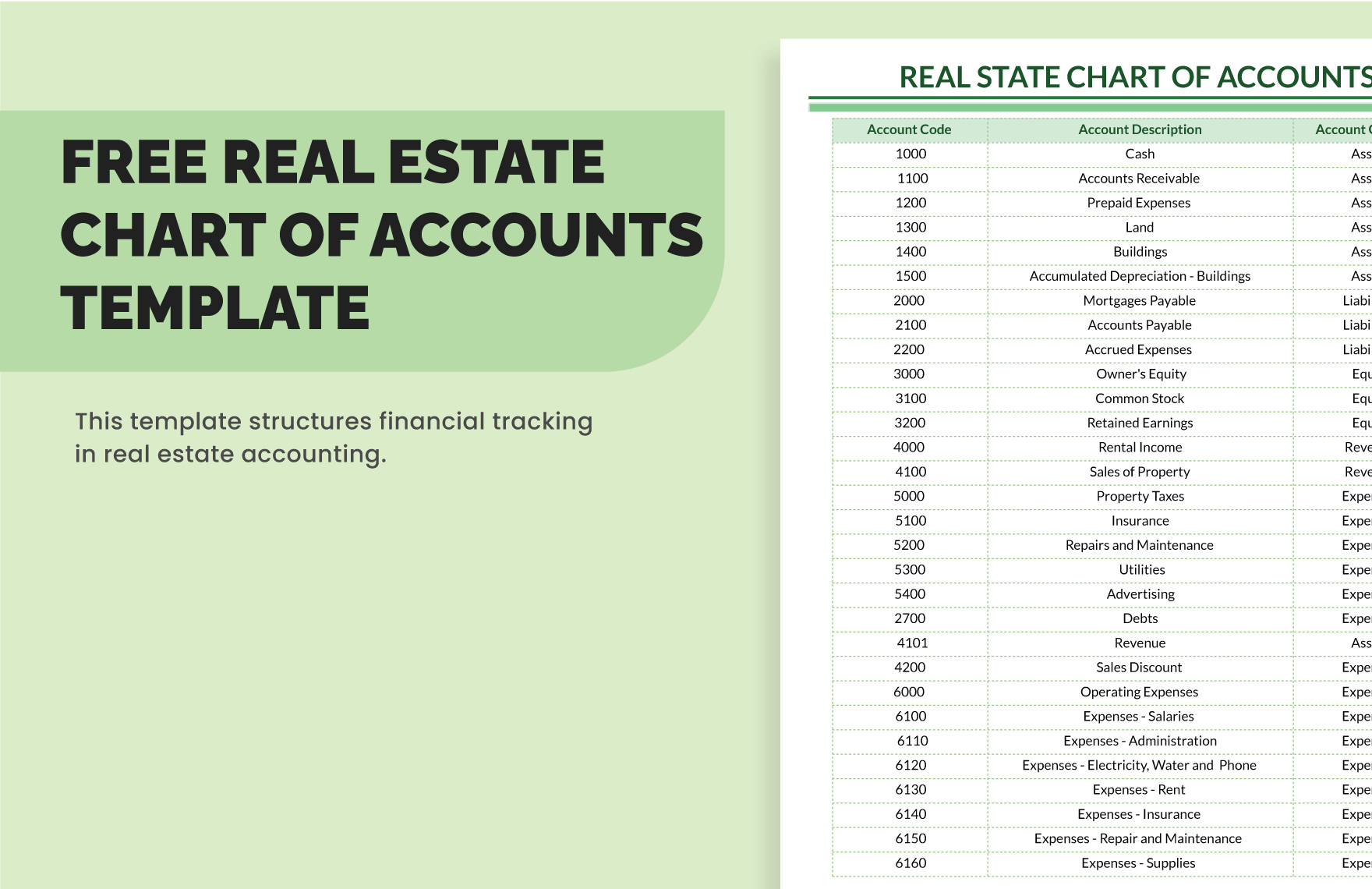

Typically included, per the previous reporting list, are assets, liabilities, equity, revenue, and expenses. Each of these is broken down into sub-categories to further articulate more granular characteristics. These “buckets” correspond to different reporting statements, which are generally split to include the balance sheets, income statements, and any work in progress reports. Here the links show examples using a construction company as the business example. There is a generally accepted numbering structure for the accounts, so everyone’s accounts appear in roughly the same order and with similar numbering.

Below, we’ll go over what the accounting chart of accounts is, what it looks like, and why it’s so important for your business. Each category will include specific accounts for your business, like a business vehicle that you own would be recorded as an asset account. A chart of accounts, or COA, is a complete list of all the accounts involved in your business’ day-to-day operations.

The first digit in the account number refers to which of the five major account categories an individual account belongs to—“1” for asset accounts, “2” for liability accounts, “3” for equity accounts, etc. The difference is that most businesses will have many more types of accounts than your average individual, and so it will look more complex; however, the function and the concept are the same. Essentially, the chart of accounts should give anyone who is looking at it a rough idea of the nature of your business by listing all the accounts involved in your company’s day-to-day operations. A COA is a list of the account names a company uses to label transactions and keep tabs on its finances. You use a COA to organize transactions into groups, which in turn helps you track money coming in and out of the company. In France, liabilities and equity are seen as negative assets and not account types in themselves, just balance accounts.

Doing this will help you stay organized and better understand how your business is doing financially. In addition, the operating revenues and operating expenses accounts might be further organized by business function and/or by company divisions. The asset ledger is the portion of a company’s accounting records that detail the journal entries relating only to the asset section of the balance sheet. Assets represent resources with economic value anticipated to deliver future value to the organization. Understanding how a chart of accounts works is important for effective financial management and reporting. COA organizes financial data into a structured format that can be easily accessed, analyzed, and reported.

A listing of the accounts available in the accounting system in which to record entries. The chart of accounts consists of balance sheet accounts (assets, liabilities, stockholders’ equity) and income statement accounts (revenues, expenses, gains, losses). The chart of accounts can be expanded and tailored to reflect the operations of the company. Asset, liability and equity accounts are generally listed first in a COA.